rsu tax rate india

Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent. Section 83b Election.

How Is Tax Calculated For Rsus Awarded By Mncs Outside India Quora

Listed below are some of the benefits of restricted stock units you need to consider.

. The bank is now offering interest rates in the range of 450 to 850 for senior citizens on FD tenures from 7 days to 10-years. The nature of the gains will. The bank will now pay an interest rate of 775.

Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Since RSUs are not a capital asset or financial or equity interest until vested these can be reported as part of other assets in schedule FA in your income tax return. On the house valued at INR 50 lakh they can save.

So you have to pay tax on all Rs 1 lac however if its RSU of a public listed Indian company your tax will be NIL because of long term capital gains but if its a out side india. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. Click here now to learn how they work how they are taxed and how to report them in 2022.

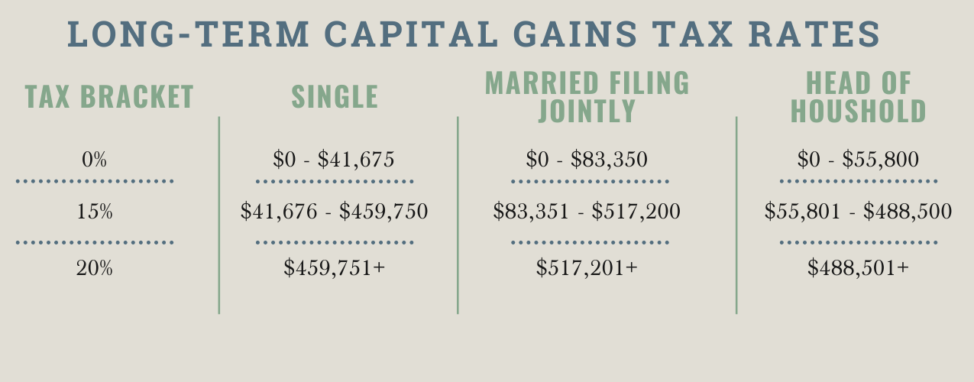

For STCG where the securities transaction tax is applicable the applicable tax rate is 15 surcharge and health and education cess. As per the tax laws of India sections 90 and 91 of the Income-tax Act deal with the concept of FTC. When an employee sells their ESPP ESOP or RSU once the vesting period is complete and receive their money it is their duty to pay tax on that amount in India.

According to the Indian government women who take out home loans are eligible for a 1 to 2 stamp duty rebate. RSUs are taxed upon the. Carol Nachbaur April 29 2022.

Also restricted stock units are subject. The Section 83b election can save those with restricted stock quite a bit of money if they play their cards right but it can also be a bit of a gamble. Carol nachbaur april 29 2022.

RSU Taxes - A tech employees guide to tax on restricted stock units. What are the taxation rules for RSUs in India. If you live in a state where you need to pay state.

Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck. On the other hand the rate for short term gains is the same as. Tax treatment of RSUs in India The RSU.

You can claim the credit of taxes paid in US while filing ITR in India. Restricted stock units RSU are not taxed like stock options. On the day if vesting 30 of the amount stocks are withheld and paid as tax to indian gov.

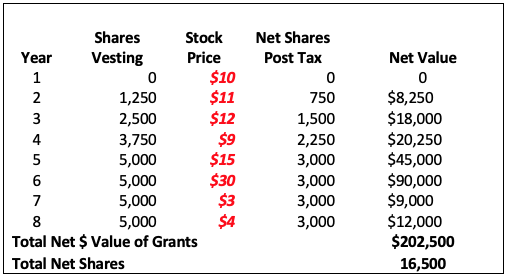

The capital gains tax rate when you. At any rate RSUs are seen as. Many employees receive restricted stock units RSUs as a part of.

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. RSUs offer several benefits to a companys employer and employees. How it works in Google MicrosoftAdobeAmazon Walmart and what will be effective tax on allocated RSUs.

All About Rsus Shares Taxes Applicable What Happens After 4 Years Truth Behind Rsus Youtube

What To Do With All Those Rsus Claro Advisors Llc Claro Advisors Llc

Rsu Taxes Explained 4 Tax Strategies For 2022

How Is Tax Calculated For Rsus Awarded By Mncs Outside India Quora

How Is Tax Calculated For Rsus Awarded By Mncs Outside India Quora

Restricted Stock Unit Taxes Your W 2 Everything Else You Should Know Tl Dr Accounting

Rsu Taxes Explained 4 Tax Strategies For 2022

Understanding Rsu Esops Espp Tax Implications Mymoneysage Blog

Rsus Can Set You Up For Long Term Financial Success

How Are Capital Gain Tax On Rsu Calculated In India Quora

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Restricted Stock Unit Technology Glossary Definitions G2

How Are Rsu S Taxed In India Specific Scenario Included Quora

The Taxation Of Rsus In An International Context Sf Tax Counsel

How Are Foreign Shares And Rsus Taxed In India Youtube

Rsu Taxes Explained 4 Tax Strategies For 2022