vermont sales tax exemptions

The New Jersey sales tax rate is currently. All Major Categories Covered.

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

This page discusses various sales tax exemptions in Vermont.

. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. Ad Fill out a simple online application. 53 rows Exemption extends to sales tax levied on purchases of restaurant meals.

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. The minimum combined 2022 sales tax rate for Piscataway New Jersey is. The purpose of resale is the exemption.

9741 9741. Select Popular Legal Forms Packages of Any Category. The Vermont Statutes Online Title 32.

Vermont Sales Tax Exemption for a Nonprofit Vermont automatically exempts eligible charities from sales tax so there is no need to apply for an exemption. Your Sales Tax Registration. Ad Keep up with changing tax laws.

Provide your business with the necessary permits to be successful. Ad Fill out a simple online application. Get the Avalara Tax Changes Midyear Update today.

To report this repair on its sales tax return the repair provider would include 1000 in LINE A. How to use sales tax exemption certificates in Vermont. The sales tax is passed on to the client.

Vermont Sales Tax Exemption Certificate information registration support. This vehicle is also. Ad New State Sales Tax Registration.

Beer over 6 percent alcohol by volume. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Groceries clothing prescription drugs and non-prescription drugs are exempt from the.

Additionally wholesalers must pay a tax on spirits and fortified wines as follows. Taxation and Finance Chapter 233. Ad Keep up with changing tax laws.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. The registrant or lessee must be licensed in Vermont as a VT Rental Company and will be required to submit a completed Rental Tax Exemption form VD-030. While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

The exempt portion of the repair 500 is recorded as an exempt sale on the sales tax return. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. Sales up to 500000.

SALES AND USE TAX Subchapter 002. The first thing is to determine your sales tax obligation. Provide your business with the necessary permits to be successful.

Get the Avalara Tax Changes Midyear Update today. This is the total of state county and city sales tax rates. Charities may however need.

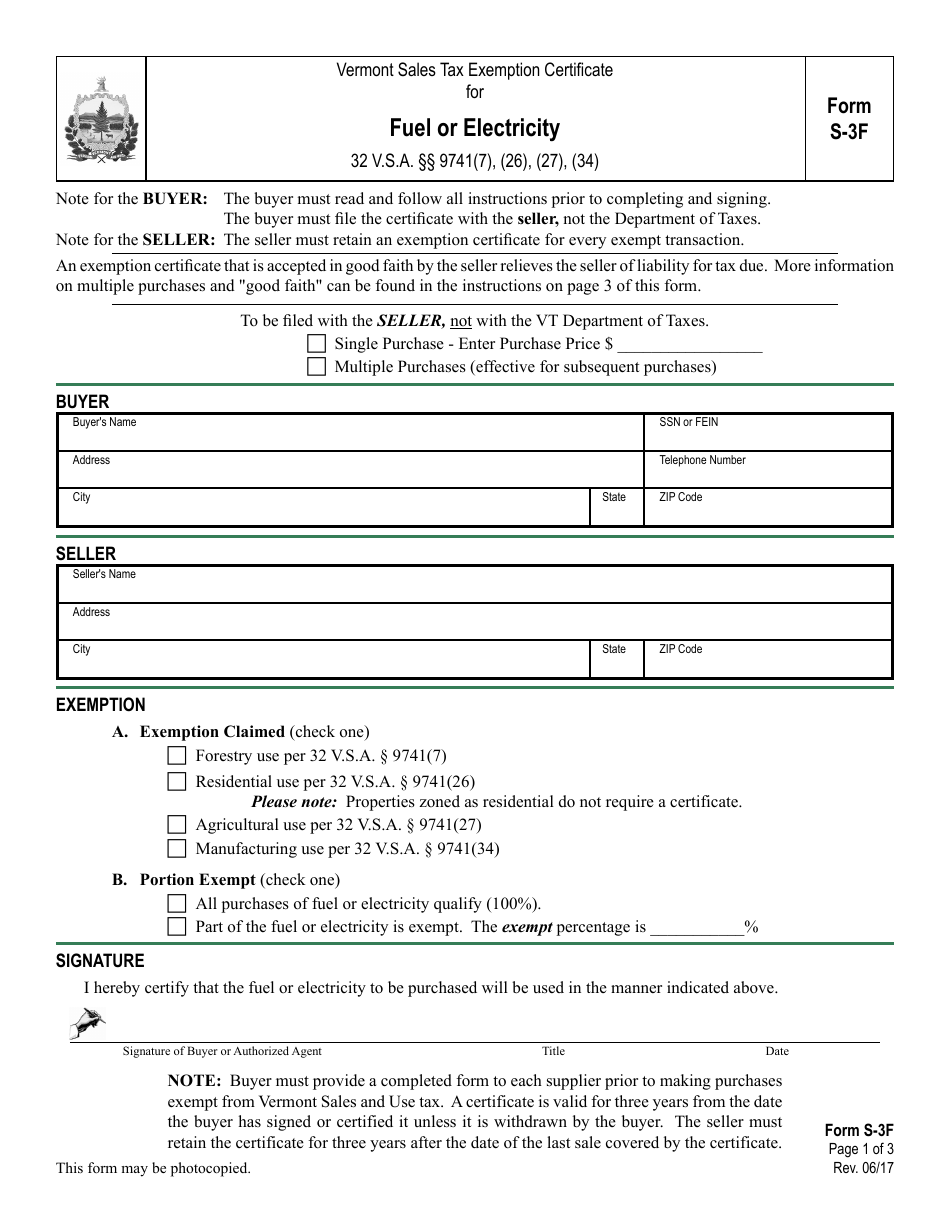

Form S 3f Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Fuel Or Electricity Vermont Templateroller

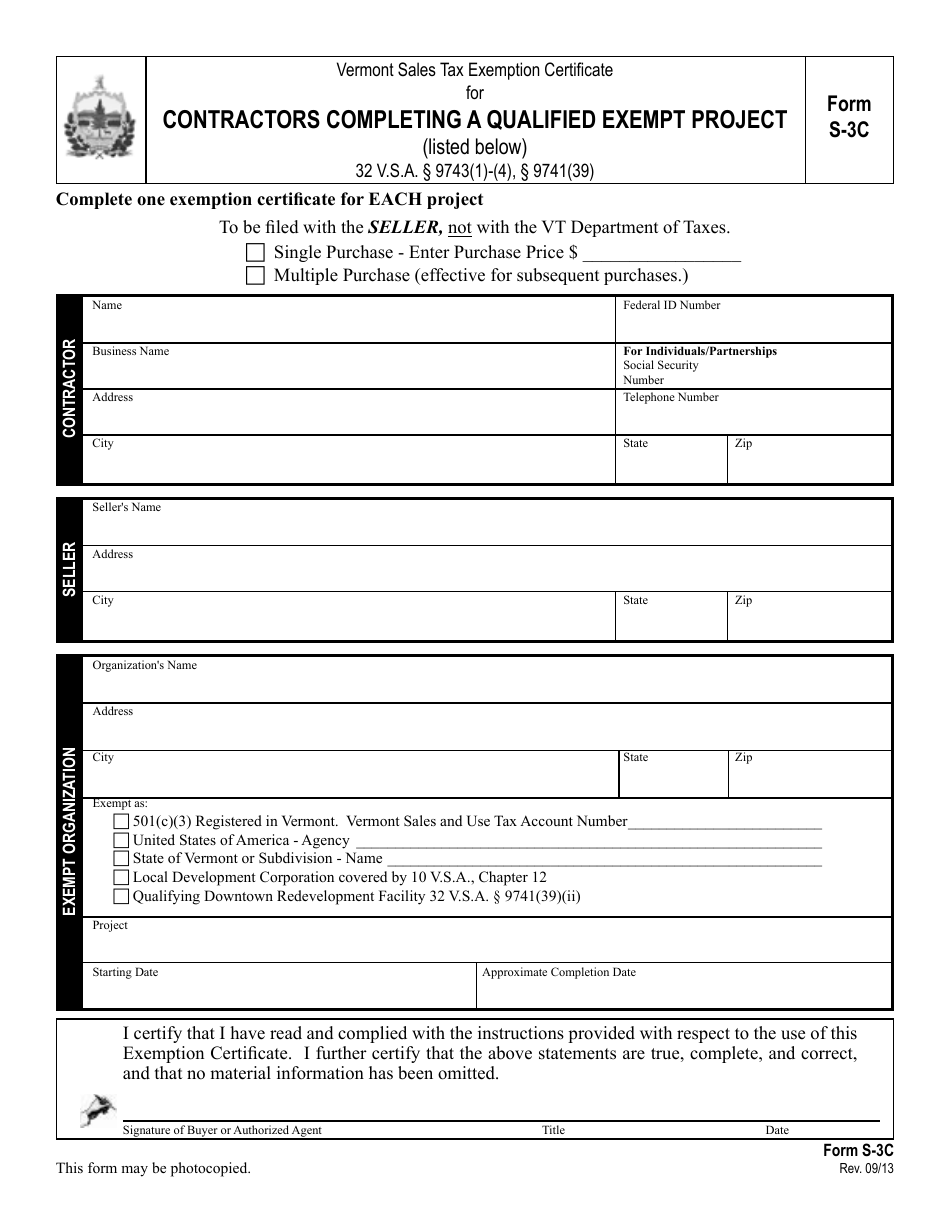

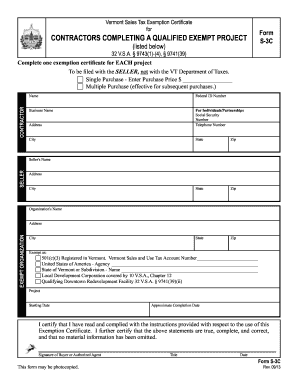

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

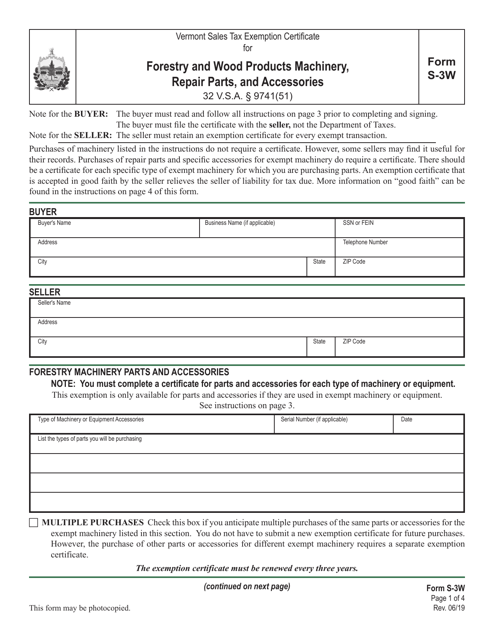

Form S 3w Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Forestry And Wood Products Machinery Repair Parts And Accessories Vermont Templateroller

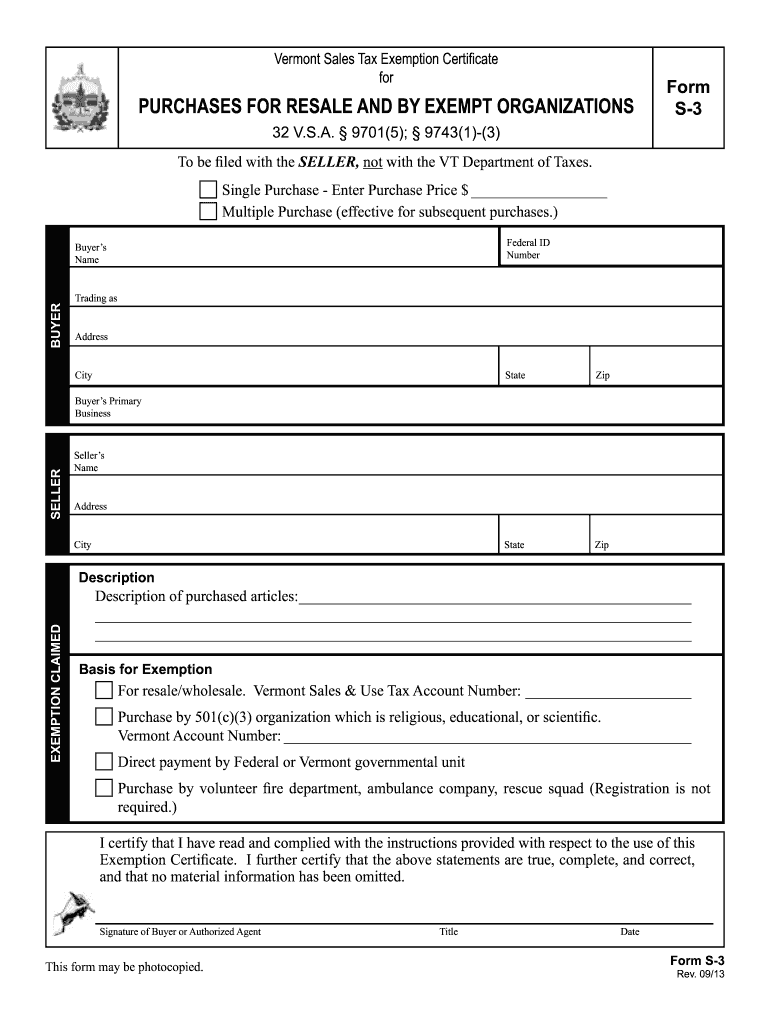

Fillable Vermont Sales And Use Certificate Fill Out And Sign Printable Pdf Template Signnow

Exemptions From The Vermont Sales Tax

Vt Dot S 3 2013 2022 Fill Out Tax Template Online Us Legal Forms

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller